48 Low-key ML packages in R

48.1 Vedant Kumar and Siddhant Kumar

48.1.1 Nuralnet Package in R

# creating training data set

weight=c(120,80,55,100,75,60)

height=c(150,165,155,175,145,170)

obese=c(1,0,0,1,1,0)

df=data.frame(weight,height,obese)

# fit neural network

nn=neuralnet(obese~weight + height,data=df, hidden=3,act.fct = "logistic",

linear.output = FALSE)

# - obese~weight + height, Placed is label(dependent variable) and

#weight and height are features (independent variable).

# - df is dataframe,

# - hidden = 3: represents single layer with 3 neurons.

# - act.fct = "logistic" is the activation function

# plot neural network

plot(nn)

#prepare a test data

weight=c(130,90)

height=c(130,185)

df_test=data.frame(weight,height)

## Prediction using neural network

Predict=compute(nn,df_test)

prob = Predict$net.result

pred = ifelse(prob>0.5, 1, 0)

print(pred)## [,1]

## [1,] 1

## [2,] 0#Part 1 - quantmod Package in R

#download the price data for Apple Inc.

getSymbols("AAPL")## [1] "AAPL"

#add parameters to the getSymbols() function and view the data using the head() function.

getSymbols("AAPL",

from = "2016/12/31",

to = "2018/12/31",

periodicity = "daily")## [1] "AAPL"

head(AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume AAPL.Adjusted

## 2017-01-03 28.9500 29.0825 28.6900 29.0375 115127600 27.33247

## 2017-01-04 28.9625 29.1275 28.9375 29.0050 84472400 27.30188

## 2017-01-05 28.9800 29.2150 28.9525 29.1525 88774400 27.44072

## 2017-01-06 29.1950 29.5400 29.1175 29.4775 127007600 27.74664

## 2017-01-09 29.4875 29.8575 29.4850 29.7475 134247600 28.00078

## 2017-01-10 29.6925 29.8450 29.5750 29.7775 97848400 28.02902

#Using financial data from multiple organisations using lapply()

stocks <-lapply(c("AAPL", "GOOG"), function(x) {getSymbols(x,

from = "2016/12/31",

to = "2018/12/31",

periodicity = "daily",

auto.assign=FALSE)} )## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume AAPL.Adjusted

## 2017-01-03 28.9500 29.0825 28.6900 29.0375 115127600 27.33247

## 2017-01-04 28.9625 29.1275 28.9375 29.0050 84472400 27.30188

## 2017-01-05 28.9800 29.2150 28.9525 29.1525 88774400 27.44072

## 2017-01-06 29.1950 29.5400 29.1175 29.4775 127007600 27.74664

## 2017-01-09 29.4875 29.8575 29.4850 29.7475 134247600 28.00078

## 2017-01-10 29.6925 29.8450 29.5750 29.7775 97848400 28.02902

chart_Series(AAPL)

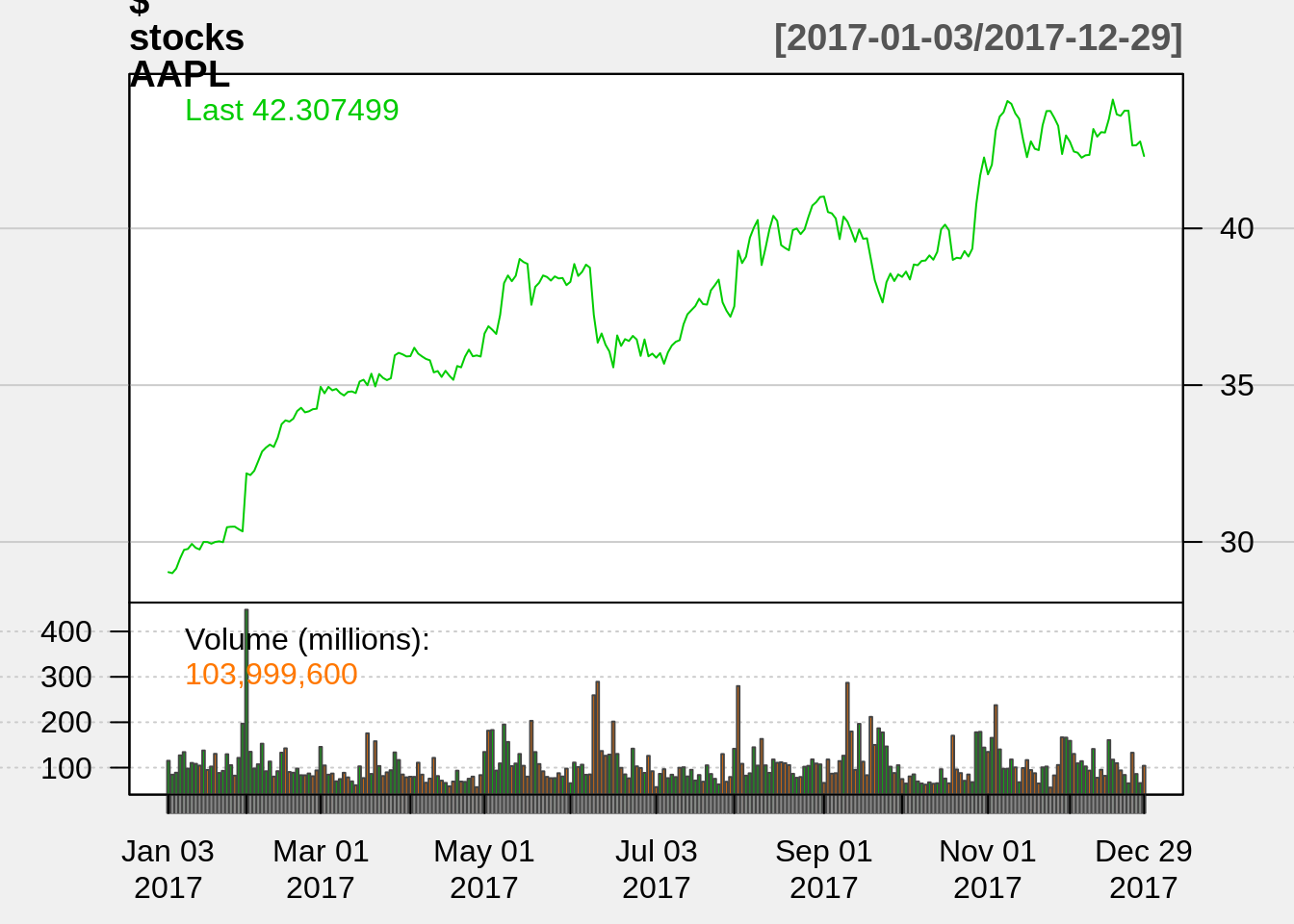

chartSeries(stocks$AAPL,

type="line",

subset='2017',

theme=chartTheme('white'))

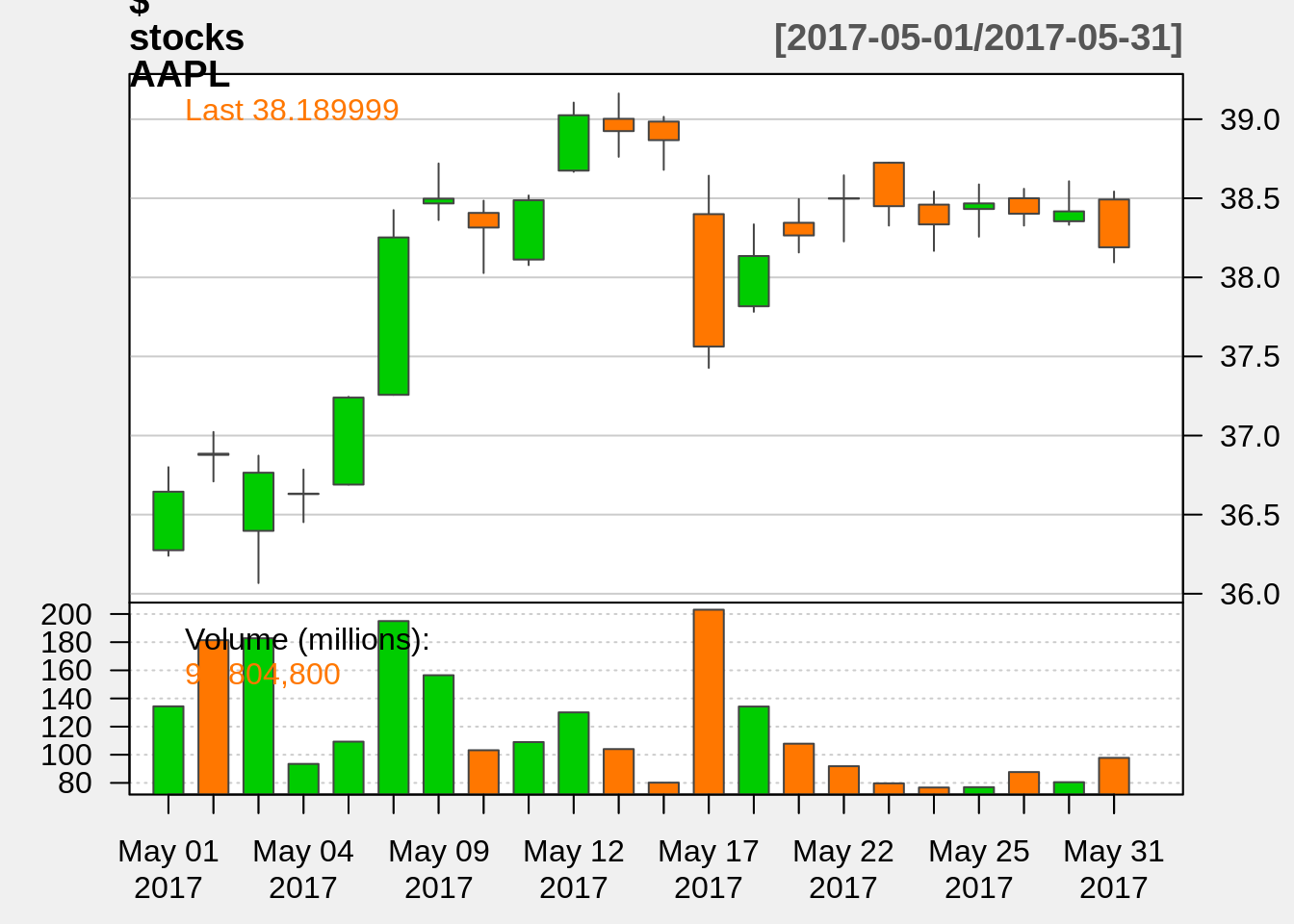

chartSeries(stocks$AAPL,

type="candlesticks",

subset='2017-05',

theme=chartTheme('white'))

#calculation of some common financial metrics

seriesHi(stocks$AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume AAPL.Adjusted

## 2018-10-03 57.5125 58.3675 57.445 58.0175 114619200 56.12624

seriesLo(stocks$AAPL)## AAPL.Open AAPL.High AAPL.Low AAPL.Close AAPL.Volume AAPL.Adjusted

## 2017-01-03 28.95 29.0825 28.69 29.0375 115127600 27.33247